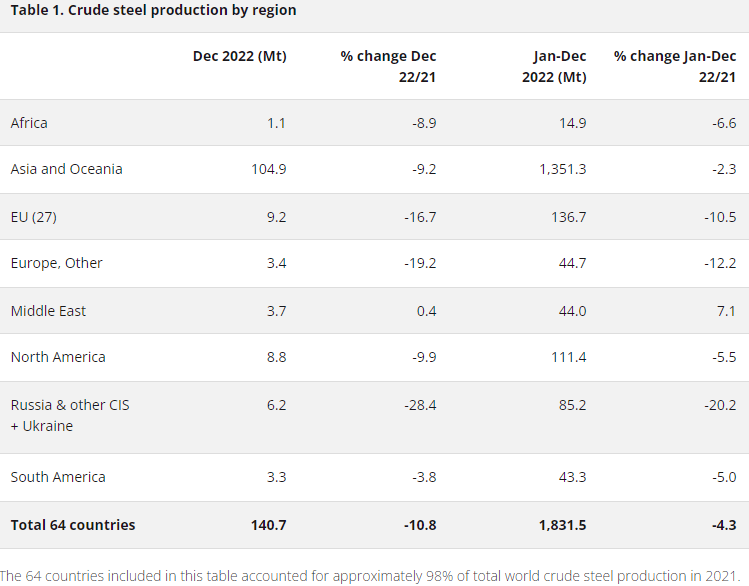

World steel production in 2022 fell 4% compared to 2021, to 1.88 billion metric tons, according to the Worldsteel Association.

Overall, steel production declined worldwide, with the global decline driven primarily by the top five steel-producing countries and Ukraine, which together account for approximately 60% of the total global decline.

Among the top five steel-producing countries, production declined in China by 22 million metric tons, or 2 percent; in Japan by 7 million metric tons, or 7 percent; in the United States by 5 million metric tons, or 6 percent; and in Russia by 6 million metric tons, or 7 percent.

However, these declines were partially offset by India, which increased its crude steel production by 7 million metric tons, or 5 percent, over 2021.

Steel production in Ukraine decreased by 15 million metric tons, or 71 percent, from 2021 as a result of the Russian invasion and the impact of the ongoing conflict.

The top five steel producing countries accounted for 73% of global steel production in 2022.

World steel production

According to the United States Steel Corporation (US Steel), the global steel industry is cyclical, highly competitive and has historically been characterized by global overcapacity.

US Steel competes with many North American and international steel producers.

Its competitors include integrated producers, which use iron ore and coke as the primary raw materials for steel production, electric arc furnace (EAF) producers, which use primarily steel scrap and other iron-containing raw materials as raw materials, and slab re-rollers, which purchase primarily imported semi-finished products, although some domestic as well, and convert them into sheet products.

In addition, other materials, such as aluminum, plastics, and composites, compete with steel in a number of applications

EAF producers typically require lower capital expenditures for facility construction and operation and may have lower total employment costs.

Some EAF producers use thin slab casting technology to produce flat-rolled products and increasingly can compete more directly with integrated producers in many flat-rolled product applications previously produced only by integrated steelmakers.

Slab re-rollers do not incur the cost of melting steel; their production costs depend largely on the market price of slabs.

![]()